A 1004D is a form in the real estate world that signifies a crucial step in the appraisal process. It acts as a follow-up report to address any discrepancies or updates required by the lender. Completing a 1004D involves providing detailed information on changes made to the property post-appraisal. This form ensures that the lender stays informed and up-to-date on any modifications that may impact the property’s value. Understanding the significance of a 1004D is essential for all involved parties in a real estate transaction.

Exploring the Mystery of 1004d: What Is It and Why Does It Matter?

The Basics of a 1004d Form

Have you ever heard of a 1004d form? If you’re scratching your head or feeling a bit puzzled, don’t worry; you’re not alone! In the world of real estate and home appraisals, a 1004d form plays a crucial role. But what exactly is it and why does it matter? Let’s dive in and uncover the mystery behind the 1004d form.

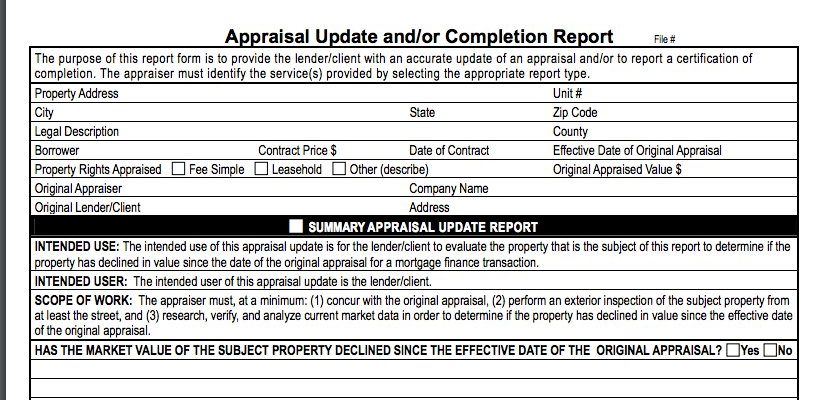

At its core, a 1004d form is a type of document used in the real estate industry to address certain aspects of a property that may need further clarification or updates. This form is commonly associated with the appraisal process of a home, which is a crucial step in determining the value of a property.

Why Is a 1004d Form Necessary?

Imagine you’re buying a house, and the appraisal comes back with some discrepancies or incomplete information. This is where the 1004d form comes into play. It serves as a way to update or provide additional details about the property to ensure an accurate appraisal.

One common scenario where a 1004d form is needed is when repairs or renovations have been made to the property after the initial appraisal. These changes can impact the overall value of the home, and the form helps document these alterations for the appraiser to consider.

Another reason a 1004d form is necessary is to address any issues that may affect the property’s value, such as damage discovered during a final inspection. By completing this form, all parties involved in the real estate transaction can ensure that the appraisal reflects the most up-to-date information about the property.

How Does a 1004d Form Work?

Now that we understand why a 1004d form is important, let’s take a closer look at how it actually works. When a lender or appraisal management company requires additional information or updates regarding a property, they will typically request the completion of a 1004d form.

The form will typically include details such as the property address, borrower’s name, lender’s information, and a section to describe the specific updates or repairs that have been made. It’s crucial to provide accurate and detailed information on the form to ensure that the appraisal reflects the most current state of the property.

Once the form is completed, it is typically reviewed by the appraiser to determine how the updates or repairs may impact the property’s value. The appraiser will then consider this information when finalizing the appraisal report to provide an accurate valuation of the home.

Common Misconceptions About 1004d Forms

Despite its importance in the real estate industry, there are several misconceptions about 1004d forms that are worth addressing. One common misconception is that completing this form will automatically result in a higher appraisal value for the property.

It’s essential to remember that the purpose of a 1004d form is to provide accurate information about the property, not to manipulate the appraisal in favor of the seller or buyer. The appraiser will evaluate the updates or repairs documented on the form to determine their impact on the property’s overall value objectively.

Another misconception is that a 1004d form indicates a problem with the initial appraisal. While it’s true that the form is often requested to address discrepancies or updates, it doesn’t necessarily mean that the initial appraisal was incorrect. Instead, it highlights the dynamic nature of real estate transactions and the need to ensure that the most current information is considered in the appraisal process.

In conclusion, a 1004d form is a vital document in the real estate appraisal process. By understanding its purpose and how it works, both buyers and sellers can navigate the appraisal process with confidence and ensure that the property’s value is accurately determined. Next time you hear about a 1004d form, you’ll know it’s not just a random number but a key piece of the puzzle in the world of real estate transactions.

When would you condition for a Form 1004D?

Frequently Asked Questions

What is the purpose of a 1004D form?

A 1004D form, also known as the Appraisal Update and/or Completion Report, is used to provide an update on the completion of construction or repairs that were noted in an original appraisal report. It is typically required by lenders to ensure that the property’s value has not been affected by any incomplete work.

When is a 1004D form required?

A 1004D form is usually required by lenders when there have been construction or repair activities on a property that were not completed at the time of the initial appraisal. It is necessary to confirm that the work has been finished and that the property’s value has not been negatively impacted.

Who completes a 1004D form?

A 1004D form is typically completed by the appraiser who conducted the original appraisal of the property. The appraiser will visit the property to assess and confirm that the construction or repairs have been completed according to the original appraisal report.

What information is included in a 1004D form?

A 1004D form includes details such as the original appraisal report reference, the nature of the construction or repairs that were incomplete, the current status of the work, and the appraiser’s assessment of the impact of the completed work on the property’s value.

How does a 1004D form affect the loan process?

A 1004D form is an important document in the loan process as it helps lenders ensure that the property’s value has not been compromised due to incomplete construction or repairs. By providing updates on the completion of work, the form helps mitigate risks for the lender and ensures the property meets the loan requirements.

Final Thoughts

A 1004D form is essentially a completion report used in the appraisal process to confirm any additional work or repairs that were needed. It serves as a follow-up to ensure that the required work has been completed satisfactorily. This form is typically requested by lenders to finalize a mortgage transaction and ensure the property meets the necessary standards. In conclusion, understanding what a 1004D is can help facilitate a smooth appraisal process and ensure all necessary steps are taken for a successful property transaction.